what is tax debt forgiveness

Unfortunately that 10-year timeline is. For a creditor to erase a portion of the debt.

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Get A Free Tax Relief Consultation.

. An OIC allows you to pay far. Start with a free consultation. Quick Free Tax Analysis Call.

Need help with Back Taxes. The IRS Debt Forgiveness Program presents taxpayers with several options to catch up on their unpaid taxes. IRS Debt Forgiveness Program.

The IRS debt forgiveness program is a way for taxpayers who owe money to the IRS to repay their debts in a more manageable way. The canceled debt isnt taxable however if the law specifically allows you to exclude it from gross income. Ad Use our tax forgiveness calculator to estimate potential relief available.

Is debt forgiveness a capital gain. IRS debt relief is for those with a debt of 50000 or less. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years.

Generally if you borrow money from a commercial lender and the. The program offers tools and assistance. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Dont Face the IRS Alone. You can also apply for the IRS. Debt forgiveness happens when a lender forgives either all or some of a borrowers outstanding balance on their loan or credit account.

Debt forgiveness can help free up your financial resources and relieve a major burden. The process can take a few years but when its. After a debt is canceled the creditor.

The Collection Statute Expiration Date CSED is the date ten years from when the tax got assessed and when the IRS writes off the debt. These specific exclusions will be discussed later. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Ad Dont Let the IRS Intimidate You. Bidens forgiveness program will cancel 10000 in student loan debt for those making less than 125000 or households with less than 250000 in income. You also risk audits and penalties if you dont file Form 1099-C.

Get Your Qualification Options Today. However there may still be tax consequences for the discharge of indebtedness. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances.

The IRS has 10. Ad As Heard on CNN. Ad Looking For IRS Help.

Our Certified Debt Counselors Help You Achieve Financial Freedom. Rated 1 by Top Consumer Reviews. A Rated BBB firm.

Free Competing Quotes From Tax Relief Consultants. Whenever there is a loan balance that gets reduced in any way either with debt forgiveness a foreclosure a short sale or a cancellation. But as we mentioned in the above section on income-based debt.

There are three ways you can seek one-time forgiveness. These standards vary from state to state. Money Back Guarantee - Free Consultation.

Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples. Debt forgiveness is a chance to start over. States also offer tax forgiveness based on personal income standards.

The IRS has the final say on whether you qualify for debt forgiveness. IRS tax debt forgiveness allows your debt to. Money Back Guarantee - Free Consultation.

In most forgiveness situations debt reduction comes with major. Apply for a Consultation. In general though the agency looks for taxpayers who.

This is essentially a settlement agreement that you set up with the IRS. A total tax debt balance of 50000 or below. AFCC BBB A Accredited.

We Have Resolved Over 1 Billion Dollars in Tax Debts for Our Clients. The closest thing to tax debt forgiveness is the Offer in Compromise or OIC. End Your IRS Tax Problems.

Your forgiven debt could mean a big tax bill depending on your earnings deductions and other factors. Free Consultation - Qualify For Debt Forgiveness. Debt settlement or debt forgiveness is a last-resort option that can help debtors get out from under overwhelming balances.

We Have Resolved Over 1 Billion Dollars in Tax Debts for Our Clients. Ad As Heard on CNN. For example in Pennsylvania a single person who makes.

The tax exception applies to the discharge of debt in any chapter of bankruptcy. Debt forgiveness is when a lender reduces the amount of debt a creditor owes or wipes away the debt entirely. At Blake Goodman PC Attorney weve.

Tax debt forgiveness is a broad term used to describe the various tax relief programs available to taxpayers who are unable to pay their tax debts. Get Free Quote Online Today. Ad End State IRS Tax Issues.

Ad Tax Debt Help. Is debt forgiveness a capital gain. Whenever there is a loan balance that gets reduced in any way.

End Your IRS Tax Problems. Ad One Low Monthly Payment. This is the main form of relief the IRS offers to taxpayers both individuals and.

Is Irs Tax Debt Forgiveness A Thing Or Too Good To Be True Debt Com

Tax Debt Relief Get Rid Of Back Taxes

Tax Debt Relief How To Handle Back Taxes Ramseysolutions Com

6 Faqs On Tax Debt Relief Act Tax Relief Center

Need Irs Tax Debt Relief Here S What You Have To Do To Get Help Credit Summit

Achieve Tax Debt Relief By A Reduction In Irs Penalties And Interest

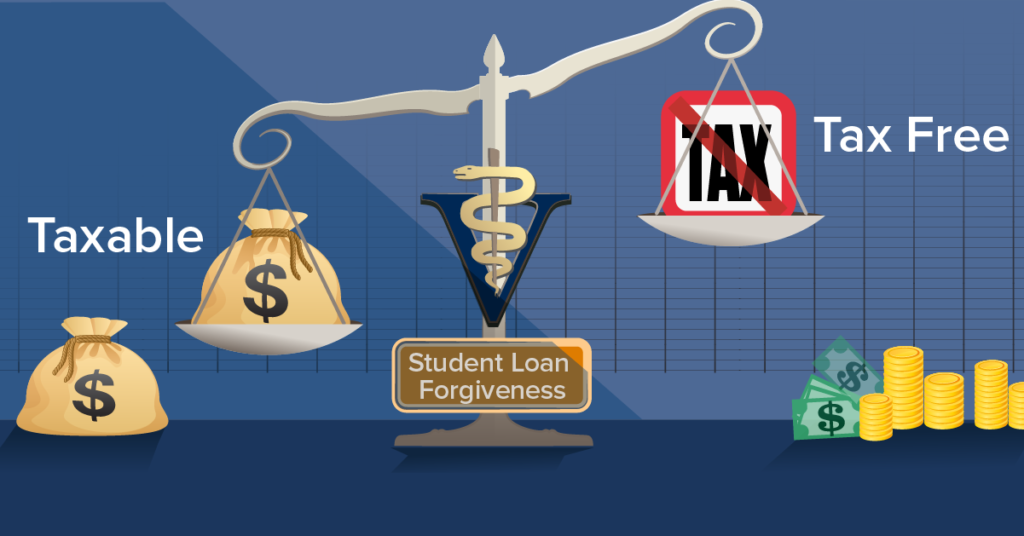

Student Loan Forgiveness Taxable Or Tax Free Vin Foundation

Is It Easy To Get Tax Debt Relief Geneva Lunch

Irs Debt Forgiveness Blog 20 20 Tax Resolution

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

Will Your Student Loan Forgiveness Lead To A Big Tax Bill

Do You Owe Taxes On Debt Forgiveness U S News

Is Student Loan Forgiveness Taxable 13newsnow Com

Blue Springs Tax Debt Relief Services

How Does Tax Debt Relief Work An Ultimate Guide Centsai

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022

How To Report Debt Forgiveness 1099c On Your Tax Return Robergtaxsolutions Com

Student Loan Debt Forgiveness And Insolvency

Irs Tax Debt Relief We Help To Remove Tax Debts Legal Tax Defense